can you opt out of washington state long-term care tax

The employee attests that they have other long-term care insurance. Republicans have pointed to the wave of departures from the program as evidence that its neither popular nor financially sustainable over the long haul without a significant increase in the.

Ltca Long Term Care Trust Act Worth The Cost

1 and leave it in place for the states review period you can.

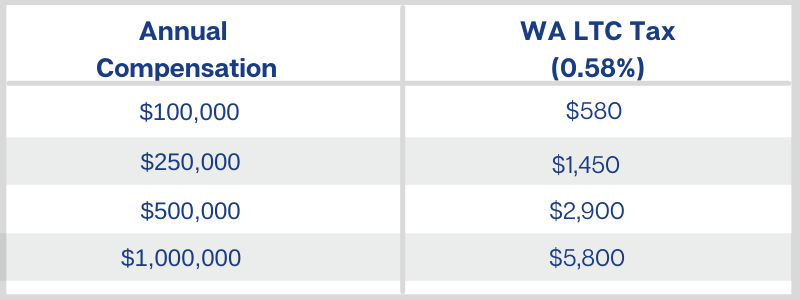

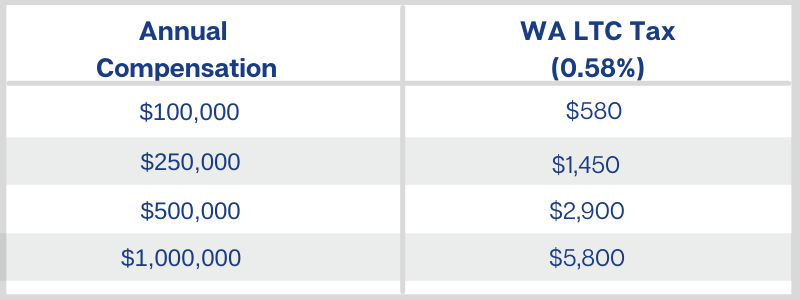

. Can I opt out. The Washington State legislature in 2021 is providing until Dec 31st 2021 this date is estimated its still being worked out to become EXCEPT from the state program and except from the 058 tax. Workers will begin contributing to the fund in July 2023.

An employee who attests they purchased long-term care insurance before November 1 2021 may apply for an exemption from the premium assessment. I have not had success. If you have children in highschool or college who will be entering the workforce after the 1231.

The benefit is not provided if the individual beneficiary moves out of the state of Washington. An employee has a one-time opportunity to opt-out if they have comparable private long-term care insurance. Under current law you have one opportunity to opt out of this tax by having a long-term care insurance LTCi policy in place by November 1 st 2021.

Beginning January 1 st 2022 Washington residents will fund the program via a payroll tax. On October 1st the window to opt-out of Washington States Long-Term Care Tax opened. Workers who live out of state and work in Washington military spouses workers on non-immigrant visas and certain veterans with disabilities will be able to opt out of the program if they choose.

The Washington state House on Wednesday voted 91-6 to delay the implementation of the mandatory long-term care payroll tax by 18 months. This is also true if you move to Washington state after the opt out window closes after 12312022 and you didnt already own long-term care insurance with a policy date before 1112021. The employee is 18 years old or older on the date they apply for the exemption.

You can opt-out permanently if you have your own long-term care insurance policy in place before November 1 2021 that provides equal or better benefits. The benefit is not provided if the individual beneficiary moves out of the state of Washington. Washington State is accepting exemption applications between October 1 2021-December 31 2022.

Employers will refund any premiums collected in 2022 so far. Once you opt-out you can never opt back in which is a good thing. In 2019 the Washington Legislature passed a first-in-the-nation law to create a state-run long-term care program.

Differences between WA Cares Fund and private long-term care insurance plans Applying for an exemption Requirements. You must then submit an attestation that. In that case the tax will be permanent and mandatory.

SEATTLE Starting Oct. You can opt out if you show proof that you have long. If you apply and are approved for an exemption youll be permanently disqualified from WA Cares.

Friday the states website to apply for an exemption to. However earlier this year the Legislature approved a one-time opt-out provision for anyone who obtains a qualified private long-term care insurance plan before November 1. The Long Term Care Trust Act included a provision allowing people to opt out of paying the 058 payroll tax as long as they could show they had other long-term care insurance in place as of Nov.

The law provides that an employee that attests that the employee has long-term care insurance may apply for an exemption from the. This is a permanent opt-out once out you cannot opt back in. Can I opt Out.

Washington workers have until November 1 of this year to opt out of buying private insurance. The Long-Term Care Trust Act was signed. Alan Cordova Flickr Listen.

The one-time opt-out opportunity expired November 1 2021. But the private market has temporarily stopped selling plans after being inundated with applications. The website has been overwhelmed with visitors.

Seattle Times staff reporter The first day for workers in Washington state to opt out of the WA Cares Fund started with a crash. WHAT IS THE TAX. If you have purchased a private long-term care policy you should start the application process soon.

This means you may never re-enroll and youll be prohibited from getting WA Cares benefits even if you need them. Employees who can demonstrate they already have long-term care insurance may apply to be exempted from paying the premium under RCW 50B04085. 1 residents can apply to opt out of the WA Cares Fund a new long-term care insurance benefit for workers in Washington state.

Yes an employee may opt-out of the Washington Long-Term Care Program and its taxes and benefits if. For those who got in before the site crashed minutes after it opened I hear it was easy. We suggest you visit it during off-hours early morning late evening or the weekend.

The program which will be funded by a. Washington states Long-Term Care Trust Act is set to take effect at the beginning of 2022 and the only time to opt out of the new tax is fast approaching. There is a one-time deadline exemption of Nov.

First to opt out you need private qualifying long term care coverage in force before November 1 2021. If you have private long-term-care insurance LTCI and want to opt out of a new long-term-care payroll tax starting in January you can apply for an exemption with the state of Washington starting today. If you have a qualifying private long-term care policy in place by this Nov.

How Do You Opt Out Of Washington State S Long Term Care Tax Youtube

Payroll Washington Long Term Care Llc

Washington Long Term Care Tax How To Opt Out To Avoid Taxes

The Washington State Long Term Care Trust Act Opt Out Is Now Available Online Parker Smith Feek Business Insurance Employee Benefits Surety

:quality(70)/d1hfln2sfez66z.cloudfront.net/11-01-2021/t_c29a232019094739ab860abd9d770ce6_name_file_960x540_1200_v3_1_.jpg)

Monday Deadline To Opt Out Wa S Long Term Care Tax Kiro 7 News Seattle

Washington State Long Term Care Tax Avier Wealth Advisors

Washington State Long Term Care Tax Here S How To Opt Out

New Wa Long Term Care Tax Delayed So Legislature Can Fix It Crosscut